How Long Do I Have to File a Hail Damage Claim for My Roof?

.jpg)

.jpg)

How Long Do I Have to File a Hail Damage Claim for My Roof?

Mar 14, 2024 2:15:36 PM

6

min read

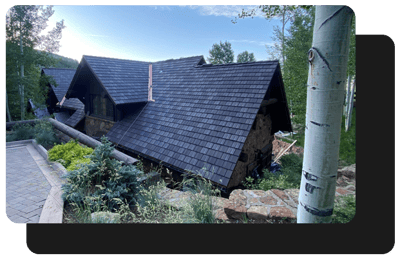

Choosing the Right Roofing Material: A Comparison of Stone-Coated Steel and Synthetic Options"

%20(1).jpg)

%20(1).jpg)

Choosing the Right Roofing Material: A Comparison of Stone-Coated Steel and Synthetic Options"

Feb 26, 2024 4:15:30 PM

6

min read

DaVinci vs. F-Wave: Which Synthetic Roofing Material Manufacturer Reigns Supreme?

.jpg)

.jpg)

DaVinci vs. F-Wave: Which Synthetic Roofing Material Manufacturer Reigns Supreme?

Feb 8, 2024 1:03:43 PM

7

min read

Synthetic Shake Roof Replacement Costs: What You Need to Know

.jpg)

.jpg)

Synthetic Shake Roof Replacement Costs: What You Need to Know

Jan 18, 2024 3:00:23 PM

9

min read

Stone-Coated Steel Roof Replacement Cost (Should You Make the Upgrade?)

-1.png)

-1.png)

Stone-Coated Steel Roof Replacement Cost (Should You Make the Upgrade?)

Jan 2, 2024 3:19:11 PM

8

min read

Making the Most of Insurance: Consider Upgrading Your Roof During a Claim

Making the Most of Insurance: Consider Upgrading Your Roof During a Claim

Dec 5, 2023 11:15:55 AM

5

min read

Which Roof System Lasts the Longest? (and How to Choose the Right One)

%20(1).png)

%20(1).png)

Which Roof System Lasts the Longest? (and How to Choose the Right One)

Nov 30, 2023 10:25:03 AM

9

min read

Class 4 IR Shingles vs. Standard Shingles: Making an Informed Choice

.png)

.png)

Class 4 IR Shingles vs. Standard Shingles: Making an Informed Choice

Aug 29, 2023 10:44:48 AM

4

min read

Navigating Unexpected Problems During Your Roofing Project: A Contractor's Guide

Navigating Unexpected Problems During Your Roofing Project: A Contractor's Guide

Aug 15, 2023 12:29:29 PM

3

min read

GAF vs. Owens Corning: A Comprehensive Shingle Showdown

-1.png)

-1.png)

GAF vs. Owens Corning: A Comprehensive Shingle Showdown

Aug 10, 2023 12:02:43 PM

5

min read