Share this

How Long Do I Have to File a Hail Damage Claim for My Roof?

by Michael Wilhelm on Mar 14, 2024 2:15:36 PM

.jpg?width=1200&height=800&name=Hail%20Damage%203824%20Blog%20(1).jpg)

Are you facing the aftermath of a hailstorm that damaged your roof? Filing a timely hail claim is crucial to receiving a fair settlement to restore your property to pre-loss conditions.

However, some homeowners don't realize their roof has hail damage until weeks or even months after the storm has passed. This is why one of the most common questions we get asked is, “How long do I have to file an insurance claim for hail damage?”

Filing a claim for hail damage to your roof without sufficient damage can impact your loss history and affect your insurance renewal process. Before contacting your insurance company, have a local contractor verify the damage to ensure the claim is valid. If damage is confirmed, contact your insurance agent to file a claim. You don't need to obtain bids before an adjuster evaluates your roof, as each insurance company follows specific criteria to process your claim.

In this blog post, we will cover the essential details of the claim filing process, including the importance of acting promptly, understanding legal limitations, and factors that can influence the filing deadline.

Whether you are navigating insurance policy terms or Colorado state-specific regulations, knowing the ins and outs of the process can help you secure fair compensation for your roof's hail damage.

Stay tuned as we guide you through the steps to take, the benefits of filing promptly, and the role of roofing contractors in the claim process. Let's ensure your roof receives the care it needs after a hailstorm.

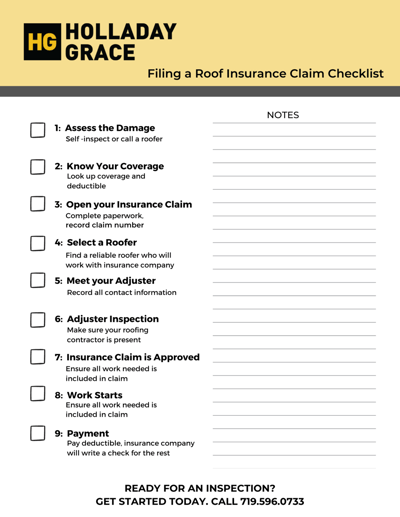

Click the Image to Download Your Roof Insurance Claim Checklist

Click the Image to Download Your Roof Insurance Claim Checklist

Understanding the Timeframe for Filing a Hail Damage Claim

The timeframe to file an insurance claim for hail damage varies across different insurers and depends on whether the property in question is used for commercial or residential purposes.

Since we specialize in residential roofing, we'll focus on that context. Typically, homeowners have up to one year from the date of the hail event to submit a claim for roof damage caused by hail.

It's important to remember that the specifics can differ from one insurance policy to another. So you'll need to review your insurance documents to get an exact deadline.

Additionally, insurance companies utilize hail tracking maps and meteorologist reports to verify the occurrence and location of hail storms. This enables them to determine whether your property was affected and when the hail event occurred. To avoid complications, we recommend filing an insurance claim as soon as you know about hail damage to your roof.

Importance of Timely Filing

Delaying the claim process can lead to denied claims. Most insurance policies set a timeframe within which you must notify them of any damage. This period can vary, but, as noted before, it's typically within one year of the damage occurring.

Legal Limitations and Exceptions, Understand Your Policy

Every policy and state has statutes of limitations that dictate how long you have to file a claim. In Colorado, for example, you most commonly have one year from the storm date to file your claim. In rare cases, you might have up to two years. Old policy language that has not been updated for a while may have exceptions for delayed discovery of damage, allowing for flexibility.

Understanding your specific policy's terms is essential, so be sure to read it and ask your insurance agent questions if it includes language you do not fully understand. Remember, acting promptly and seeking professional help can make a difference in how smoothly your claim progresses.

Factors Influencing the Filing Deadline

The filing deadline for a hail damage claim is influenced by insurance policy terms, including specific deadlines and prompt notification requirements, as well as state-specific regulations that vary, notably in hail-prone areas like Colorado. Understanding and adhering to these factors is crucial for maximizing coverage and avoiding claim complications.

Insurance Policy Terms

Each policy has its own deadlines and requirements for filing a claim.

Insurance policy terms outline crucial aspects of coverage, including policy deadlines and requirements for prompt notification. These terms can serve as a roadmap for policyholders, detailing the actions they must take in the event of an incident. Deadlines are specified for filing claims or providing notice of a loss, emphasizing the importance of timely communication with the insurance company. Prompt notification is typically required to ensure the insurer can adequately assess the situation and provide timely assistance.

Understanding and adhering to these policy terms are essential for policyholders to maximize their coverage and avoid potential complications during the claims process. It's vital to read your policy closely or consult your insurance agent to understand these specifics.

Colorado State-Specific Regulations

State laws can significantly impact claim submission deadlines. Each state has different rules, regulations, and laws regarding insurance claims. For example, Colorado experiences much more hail storms than other parts of the country. Colorado hail claims follow state-specific regulations that may differ from those in other states.

Steps to Take When Filing a Hail Damage Claim

Click through the carousel to learn the essential steps to ensure a smooth and successful claim process for your roof:

%20(1).jpg?width=1200&length=1200&name=HG%20PDF%20Guide%20-%207%20Steps%20to%20Getting%20Your%20Roof%20Insurance%20Claim%20Approved%20(1200%20x%20800%20px)%20(1).jpg)

Benefits of Filing a Hail Damage Claim Promptly

Filing a hail damage claim promptly after a storm can offer numerous benefits to homeowners. Acting swiftly helps mitigate further damage to the property and ensures that you receive fair compensation from your insurance company. This timely approach is crucial for your home's overall maintenance and financial protection.

Preventing Further Damage

Quickly addressing repairs can prevent additional damage to your roof, potentially saving you from further financial loss. Temporary measures such as tarping damaged areas or sealing leaks can prevent water infiltration. Taking these proactive steps to minimize future risks can prevent the exacerbation of existing damage and demonstrate responsible property management to insurance companies.

When hail damage is left unaddressed, it can lead to more severe problems over time. For example, small dents or cracks in roofing materials can allow water to seep through, leading to leaks, mold, or even structural damage. By filing a hail damage claim promptly, homeowners can have the damage assessed and repaired quickly, preventing these minor issues from escalating into major and costly repairs. This proactive measure preserves the roof system's integrity while maintaining your home's value.

Ensuring Fair Compensation

Filing a claim immediately after experiencing hail damage is crucial for securing fair compensation for the necessary repairs. It's important to contact a local roofing contractor to inspect the damage, as insurance companies require detailed documentation of damage for claims processing, and immediate action allows for an accurate assessment of the harm caused by the storm. Additionally, having your contractor meet with the claims adjuster helps avoid disputes over the extent of the damage and ensures that the compensation received reflects the actual repair costs. Promptly filing a claim also signals to your insurer that you're actively safeguarding your property, which can lead to a more efficient claims process.

Understanding the Role of Roofing Experts During Your Claims Process

Filing a claim for hail damage to your roof without sufficient damage can impact your loss history and affect your insurance renewal process. This is why enlisting the help of experienced roofing contractors is invaluable.

It's essential to work with a contractor familiar with insurance-related projects. Contrary to popular belief, you should have your contractor verify the damage to ensure the claim is valid before contacting your insurance company. If the damage is confirmed, you can proceed with filing a claim. Once assigned an insurance adjuster, have your contractor meet with them to discuss the scope of damages.

Working with a qualified roofing contractor will increase your chances of receiving fair compensation and experiencing a smooth claims process.

Hiring Roofing Contractors

Selecting contractors with experience in hail damage repairs ensures that your roof is adequately assessed and all necessary repairs are identified and properly documented.

Insurance companies utilize two software systems for estimating: Xactamate and Symbility. If you or your contractor are unfamiliar with reading these estimates, it can be quite confusing, leading to underpaid claims.

For tips on hiring a roofing contractor, read our post: How to Compare Roofing Contractors

Conclusion

Navigating the hail damage claim process can be daunting, but understanding the importance of timely filing, knowing the steps to take, and seeking professional assistance can make all the difference. By taking prompt action and utilizing the expertise of roofing contractors, you can secure the compensation needed to restore your roof to its pre-storm condition. Don't let the complexities of insurance claims delay your roof's recovery. Start the process today to protect your home and peace of mind.

Since 1979, Holladay Grace has helped thousands of homeowners with insurance-related projects. If you’re local to the Colorado Springs community, we would love to help you with all your roofing needs.

No Comments Yet

Let us know what you think